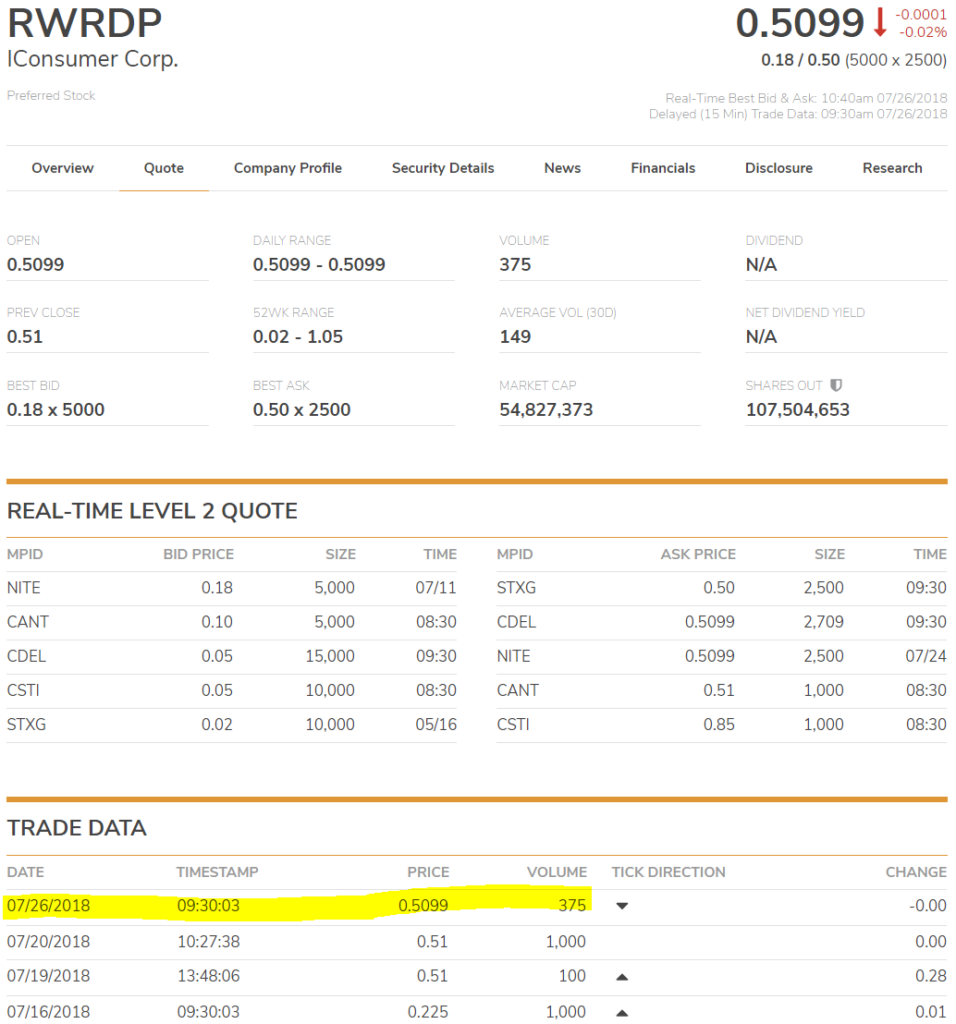

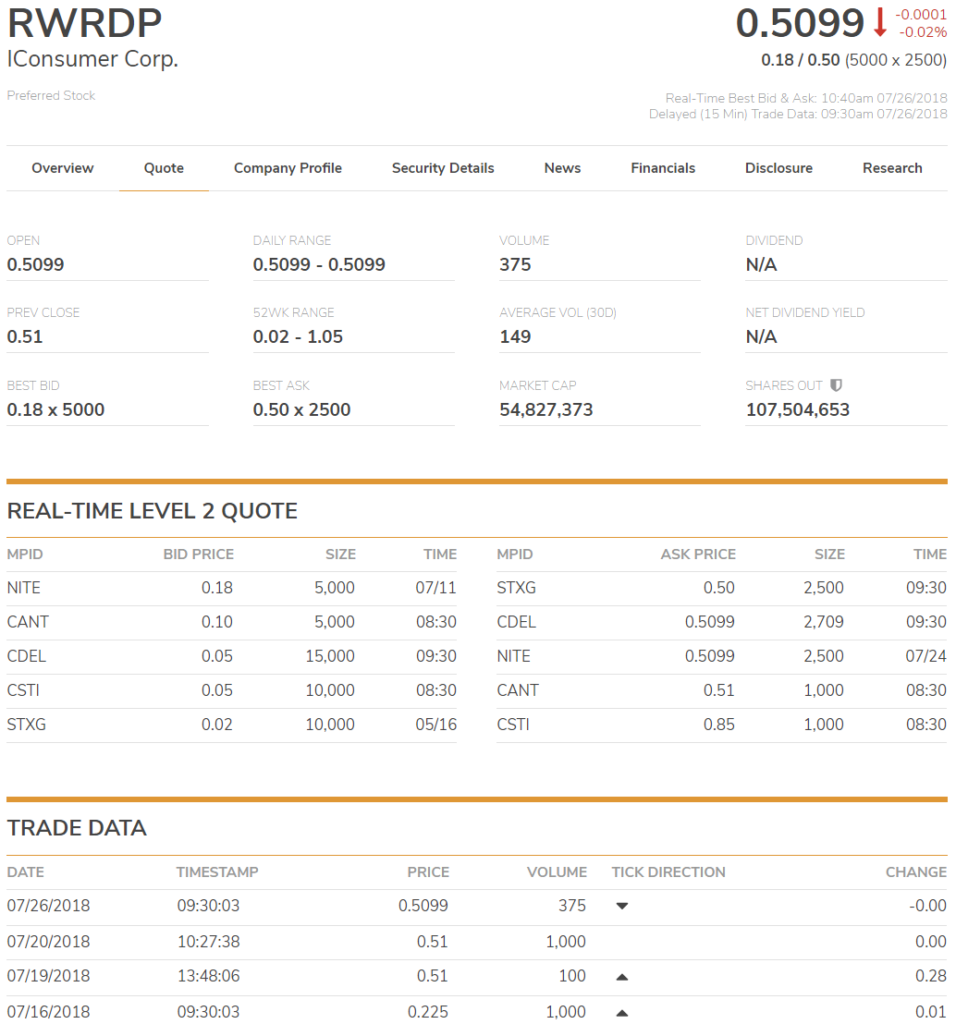

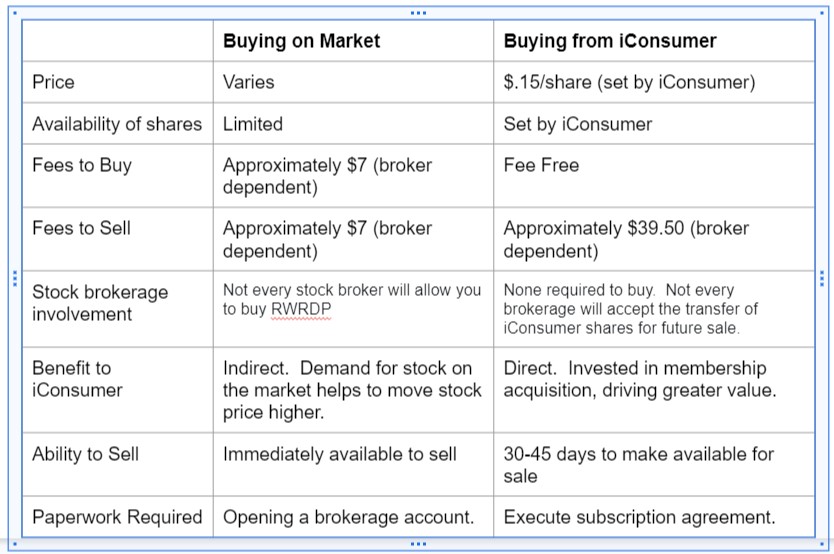

During our last webinar we got a great question. Should I buy RWRDP on the stock market, or buy it direct from iConsumer?

Quick Answer

If you’re going to invest a small amount (hundreds, not thousands), buy on the market (if the price is right). It’s easier and faster, not to mention you’ll probably get a better price right now. If you’re investing a larger amount our guess is that you’ll want to buy directly from us.

A word of warning, that answer may change overnight.

iConsumer is unique. Because we’re raising money to fund new member acquisition, right now we’re selling our stock directly to the public – sort of the world’s longest IPO. Some deets: we’re a “direct issuer”, we are selling our stock at $.15 per share and we’re not allowed to sell it “at market”.

We may stop selling to the public without notice. We may change the minimum investment amount at any time.

Here’s why being a “direct issuer” is a “complexifier” (thanks Jeff Bezos for that word). The market (the OTC stock market) may have (and currently does have) a different price from our offering price. The last time somebody bought our stock, they paid $.05 per share. Before that, $.125. Before that, it was around $.14/share, and before that, higher than $.15/share.

That means you need to choose whether to buy at $.15/share from us, or some other price from the market.

Because we’re so thinly traded, just 100 shares traded moves the stock price radically (up or down).

Our stock market and stock price strategy

We are focused on building long-term value in iConsumer. While we love our stock price to go up, it’s too soon for a startup like iConsumer to be doing anything to worry about that. We are catering to investors who have a longer time horizon. There are lots of tricks we might play to get our stock price up in the short term. They’re all pretty stupid in the long term.

Which is better for you, and which is better for iConsumer?

No matter how you buy iConsumer’s stock, iConsumer benefits. If you’re buying in the stock market (using your stock broker), somebody hopefully is making some money selling their stock to you. The more people who want to buy our stock, the more likely our stock price will go up.

That’s a very important indirect benefit to iConsumer.

If you buy stock directly from us, we’re spending that money you’re investing on new member acquisition, which is intended to make us more valuable, which in turn is supposed to help our stock price go up. Your investment has a direct benefit to us.

Benefits to buying in the market

- Potentially lower purchase price: you’ll make more money if the stock price goes up.

- Your stock is held immediately in a stock brokerage account (selling it is less complicated).

- Lower transaction cost to buy and sell your shares. It’s about $7 to buy, and $7 to sell. These are the fees the stock broker charges you. Different brokers charge differently.

- Most stock brokers will handle the buying and selling of RWRDP.

Challenges to buying in the market

- Very little stock for sale (less than $3,000 worth of stock for sale at less than $.15/share). In other words, the price of our stock could very well go up beyond $.15/share if somebody tries to buy more than $3,000 worth. (We actually like it if the stock price goes up.)

- Most, but not all, stock brokers will allow you to buy RWRDP because it’s low priced and traded on the OTC market.

Benefits to buying directly from us

- Your investment directly and immediately goes to building a more valuable business. Every $20 or so helps us attract a new shopper. Each new shopper is currently generating an estimated $75 or so of lifetime value. And THAT should generate an increase in enterprise value, which is definitely supposed to translate into a higher stock price.

- Lots of stock for sale – you can invest more than $3,000 and get the same price per share.

- Transaction costs to buy are zero!

- You get information updates directly from iConsumer.

Challenges to buying directly from us

- It’s harder to turn around and sell the stock immediately since it takes about 30-45 days to get the stock transferred onto the transfer agent’s books, and then into your stock brokerage account.

- There is paperwork to sign to buy and transfer the stock (not terrible, but any paperwork is too much paperwork).

- Transaction costs to sell are probably slightly higher ($40 or so).

- Not every stock broker will take transfers of iConsumer stock.

Which to Choose?

We want you to buy our stock. Either way you choose is great for us. Buying on the stock market can help fuel a short term rise in the stock price. The stock price going up is a wonderful thing to see. You may get in on iConsumer at a lower price, never a bad thing.

Buying directly from us helps to fuel a longer term rise in value, which we hope translates into a higher stock price over time.