I’m glad to report that we’re making progress on several fronts. This week was probably the highest volume of our stock being traded in the market, ever! And the week isn’t over. Three things, at least, contributed to our progress.

Stock Transfer / Reverse Split

As I’ve written before, we’re working on this. Transferring stock you’ve earned or purchased from iConsumer to a stock broker is currently too hard. We’re pursuing several avenues to make it easier, and one of them bore some fruit. More on that in the liquidity discussion, below.

One avenue, once we get bigger, is to uplist to an exchange (NYSE or NASDAQ). As part of that, we’d execute a reverse split. It is possible for us to do the reverse split early, prior to being ready to uplist. There are lots of pluses and minuses to doing a reverse split, especially if doing it early.

Research is yielding a split opinion on the wisdom of doing an early reverse split (sorry, couldn’t help the pun). We’ve talked to some of the biggest brokerage firms that handle our wealthy investors’ holdings. Uniformly, they felt that a reverse split would remove one of the barriers to transferring our stock into their firms, regardless of whether we uplisted or not. A similar opinion was received from service providers in the micro cap marketplace.

As we brought up the concept of a reverse split among some of our other shareholders, we heard loud and clear that their experiences with reverse splits were bad. Those splits were not in the context of an uplisting. Rather, they had occurred in already troubled companies as a last ditch effort to keep a listing.

It’s clear that if we’re able to make it easier for our shareholders to transfer their stock without doing a reverse split, that would be better.

Liquidity

Making it easier and more attractive to buy and/or sell our stock in the stock market is one of our priority goals. The more stock that’s available to be bought or sold is a big component of that. That’s the transferring stock issue discussed above.

Some background: without having had an IPO, there is very little of our stock held by short term speculators. Most of our stock is held by people who expect to hold it for a very long time, waiting for (and expecting) an amazing return on their investment. The opposite of short term. Their stock isn’t available to be bought or sold easily.

The balance of the stock is held by insiders, who, even if they want to (we don’t), aren’t allowed to easily sell their stock.

Adding to the problem is that it hasn’t been easy for shareholders who might have a shorter term perspective to transfer their shares into a brokerage account to potentially sell them. (Are you sensing the running theme here?)

We worked closely with a couple of shareholders who agreed to potentially accept a lower price for a small portion of their shares (still making a very nice profit, just not a 10X profit) in the belief that the balance of their shares will get even more valuable if we increase liquidity. We worked with a brokerage firm to get those shares transferred and deposited. It took about four months and way too much legal effort, but this week some of those shares finally got sold.

To recap what happened here: The number of shares didn’t change, the underlying value (market cap) didn’t change, but the number of shares easily bought or sold went up. And hopefully that will increase the value of iConsumer for all of us.

Member Growth / Pandemic Pivot

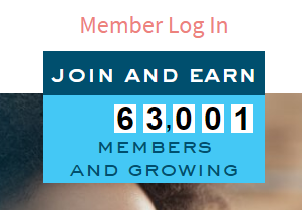

You can see the number right on our site. This image is from a couple of days ago.

We’ve made a strategic decision to offer cash back during this pandemic. We expect to continue that through the end of August, at least. Doing Maximum Cash Back has several consequences. Our revenues are probably 500% more than they would be otherwise, and our gross margin is significantly impacted.

One of the hoped-for consequences was increased membership growth. And if you’ve been watching our site, you’ve been seeing that. So much so that we’re launching some advertising campaigns in August. We believe that a combo of display, social media, and search is right for us during these unusual times. We’re starting slow, but if you see something, let us know.