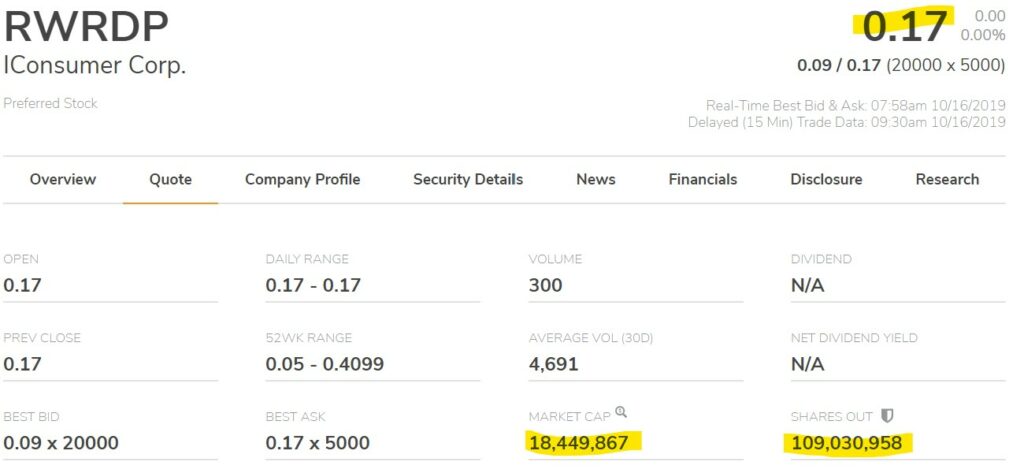

Recently, we completed the transfer of a bunch of shares from iConsumer’s books to the transfer agent’s books. They completed that transfer last week, and this week, you can finally see that the OTC market site reflects the increased number of SHARES OUT (shares outstanding).

Two things I’d like to highlight here. Our stock price wasn’t affected by the increase in the number of shares. So our MARKET CAP (market capitalization = price per share times the number of shares outstanding) went up. That is, according to the market iConsumer is worth more, and your shares did not change in value. In finance lingo, issuing more shares was “accretive” or at worst “neutral”. Had the price per share gone down, the market would have said issuing more shares was “dilutive”.

Now the word of caution. Because our stock is so illiquid and so volatile, you can’t really draw those conclusions at this time. But it’s a great opportunity to show what might happen in the future, when our stock is more widely and frequently traded.

Transferring shares is still not perfect. The transfer agent did NOT record a couple of transfers. We don’t know why yet, but we’ll fix that this week. So if you’ve transferred shares to Issuer Direct, but can’t find them there, don’t fret. We’re on it. The entire process is about as manual as it gets, with Excel spreadsheets being used to exchange information.