This year it’s all about cash

The phrase “cash is king” has never been truer.

Our Form 1-SA was filed with the SEC on Friday. It’s our financial recap of the first six months of 2021. In this posting I get to go into more detail about what we’ve experienced, why we’ve experienced it, and some thoughts on the balance of the year. All with a focus on cash.

The Form 1-SA has to stay within certain boundaries, by law and custom. This post is me sharing my opinions. I could be wrong, and the future may turn out differently. The lawyers call these forward looking statements, and they are subject to change without notice.

Cash Gross Profit

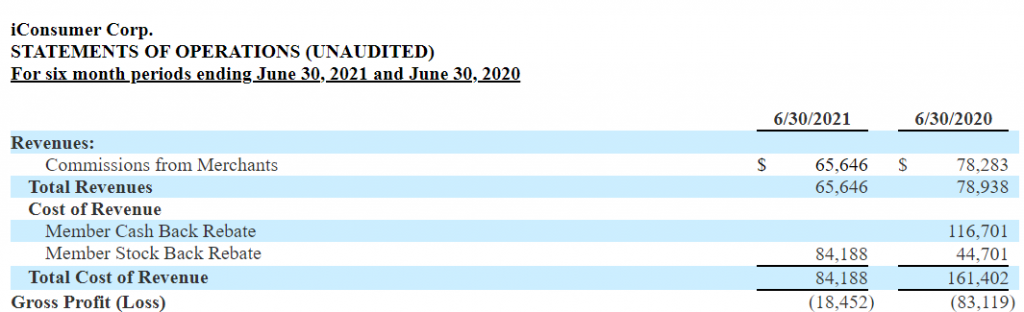

Unlike most businesses, we have a cost of revenue that doesn’t affect how much cash is ultimately generated by our revenues. That cost is the expense of granting stock to members when they shop. The “Member Stock Back Rebate”. We grant the stock, it is an expense, but there is no cash consequence of granting that stock. Which distorts our results dramatically.

I try to undistort that by discussing what I call our “cash gross profit“, the amount of cash generated by every transaction. It’s not a traditional accounting measure. The statement of cash flows does adjust for this distortion, but I find this approach simpler.

For the first six months, we granted $84,188 in stock, and that was our ENTIRE cost of revenue. When you add that back, you’ll see that we had a Cash Gross Profit of $65,646. Doing the same adjusting math for the first six months of 2020, we had a Cash Gross Profit of -38,418. That’s a NEGATIVE $38,418.

Put another way. In 2021, members generated $65,646 in cash that we could use to run iConsumer. In 2020, we had to finance $38,418, because we owed members that much more in cash than we took in.

In retrospect, it worked

The pandemic was a complete and very scary unknown. Effectively giving away money last year kept us in business. We WERE able to finance the negative cash flow. But I am much, much more comfortable with generating cash from members’ shopping than spending cash that way.

We still used more cash than we generated

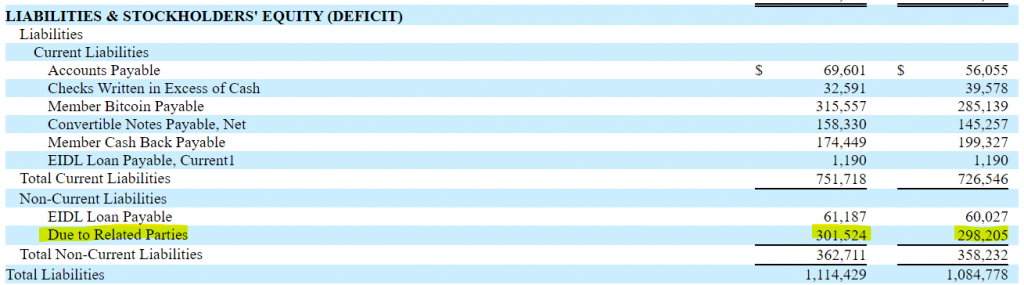

Like many growing companies, we use cash. No problem there, so long as you can finance the growth at an affordable cost. Last year, we had three major sources of financing. We got a $60,000 loan from the SBA, we had an investor invest $100,000 and my related company, OSS, waived the fees it charges to iConsumer.

For the first six months of this year, OSS continued to waive the fees, but that was about it in the way of external funding.

As you can see, the money we owed OSS went up only about $3,000. Had OSS charged iConsumer for services, instead of waiving those fees, we would have owed OSS an additional $13,129. Since OSS employs me, I’m really interested in making sure we’re in a position to start paying OSS for my services. But not yet.

We invested heavily using cash and stock

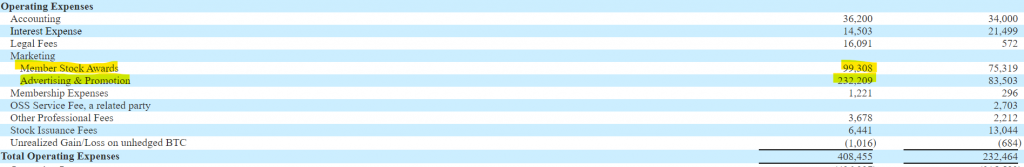

The last piece of the puzzle involves the future. Things began to return to a new normal in the first half of the year. The delta variant of the coronavirus hadn’t yet caused real concern. We decided to “up our game”. We began advertising, we hired outside firms to do additional marketing for us, and we became generally more aggressive in seeking growth.

We used our stock, instead of cash, heavily. But we also used cash. Member Stock Awards are a non-cash item, and the Advertising & Promotion expense included $90,000 of stock paid for services. Which means that we spent $43,000 in cash in 2021 versus $8,200 in 2020.

Looking forward

Recently, I’ve taken to telling anybody who will listen that they should consider investing in iConsumer. We’re not currently actively looking for people to invest in iConsumer directly; rather, I’m encouraging folks to look at buying our stock in the stock market. At the same time, I urge the folks who invest (whether by earning our stock, or buying it in the market) to think of us as a long term investment. To not think you’ll be able to sell quickly at a tasty price. To be a more typical “public” company probably requires us to reach a $4 per share stock price.

The investments we made earlier in the year are beginning to bear fruit. We have an influencer program in test that has just begun generating thousands of dollars in new revenue monthly. We’ll see if that continues, but it is bringing a smile to my face. The metrics for shopper involvement continue to improve. Our mobile app technology has seen a couple of significant improvements this year.

If the momentum continues to build through the holiday months, I’m considering trying to raise capital in the second quarter of 2022. Our march to being a $4 per share stock will most likely require institutional involvement. A great way to have that is to have institutional money invested in us, which hasn’t happened yet.

The best way to support your company in reaching that $4/share goal is to shop via iConsumer and to tell your friends they should, too. Amazon, Walmart, and 2300 other stores make that an attractive option. We make it easy to never forget with the iConsumer Button and our mobile apps.

Thanks for you interest and support.