What a year. And it’s only been six months.

Our Form 1-SA recounts our financial journey for the first half of 2020. The year the Covid-19 pandemic started. The world changed. Our world changed. We reacted starting in April by changing our business model to a cash back-centric offering. Our interest was survival. It was completely unclear at that point what was going to happen to shopping and online shopping.

As I write this in late September the future is clearer, but by no means clear. We’re all adjusting. Online shopping is a good place to be.

If you have the time, read the 1-SA. We’ve spent a lot of time explaining things in significant detail in those statements. What follows here is really only skimming the ins and outs of your business.

These statements are historical. They don’t paint a good picture of where we are at today or where we may end up. But they’re great to learn from, so dig on it.

Overview

From January 1 through mid April we were awarding only stock. For the first month and a half business was slow, but normal. In February we began to see changes, and by mid March everything had changed. Nothing was normal. Beginning in mid April we began rewarding shoppers with both cash and stock rebates. The target cash back rebate was 95% of our commission revenue. We called our new offer our “Pandemic Pivot”.

That 95% cash back does have some positive aspects for membership and revenue growth, but the major negative aspect is that it doesn’t generate sufficient cash to operate the business in the short or mid term, even in the best of times.

To help iConsumer make it through the pandemic, in March the company that I own (OSS), which provides most of the services to iConsumer, reduced its fees from 20% of iConsumer revenues to 0% (iConsumer has no employees, OSS employs everybody).

On top of my additional support for iConsumer, we cut any and every expense we could. This is where the positive aspects of 95% cash back would hopefully kick in. We’d have more visibility and interest because our cash back rate was so high. So we’d naturally get more traffic and business without spending more money on marketing.

Rebalancing between cash back and equity back

We did not change the equity back portion of our offer as part of our pivot in April. We didn’t want to change too many things all at once. Since we’re giving so much cash back, it makes sense to adjust the stock back portion. Our plan is to do that beginning in October.

The effect of “giving away” our equity

This discussion is mostly a repeat from years past. But it’s still quite important.

You actually earn our equity (we’re not giving it to you – the SEC and our accountants really want us to emphasize that). I agree, it’s important to account for that. But it has no cash effect. That is, you are getting value, but our bank account balance doesn’t go down. Cash is king. Especially for startups.

The inclusion of the stock portion of the reward in these statements masks the cash effect, and that’s distracting for cash management purposes. The Statement of Cash Flows (scroll to page 9) goes a long way to present the numbers in a helpful manner. I’m going to go one step further to help you look at what I look at by also unpacking the Gross Profit number (from page 8) in more detail to focus on cash.

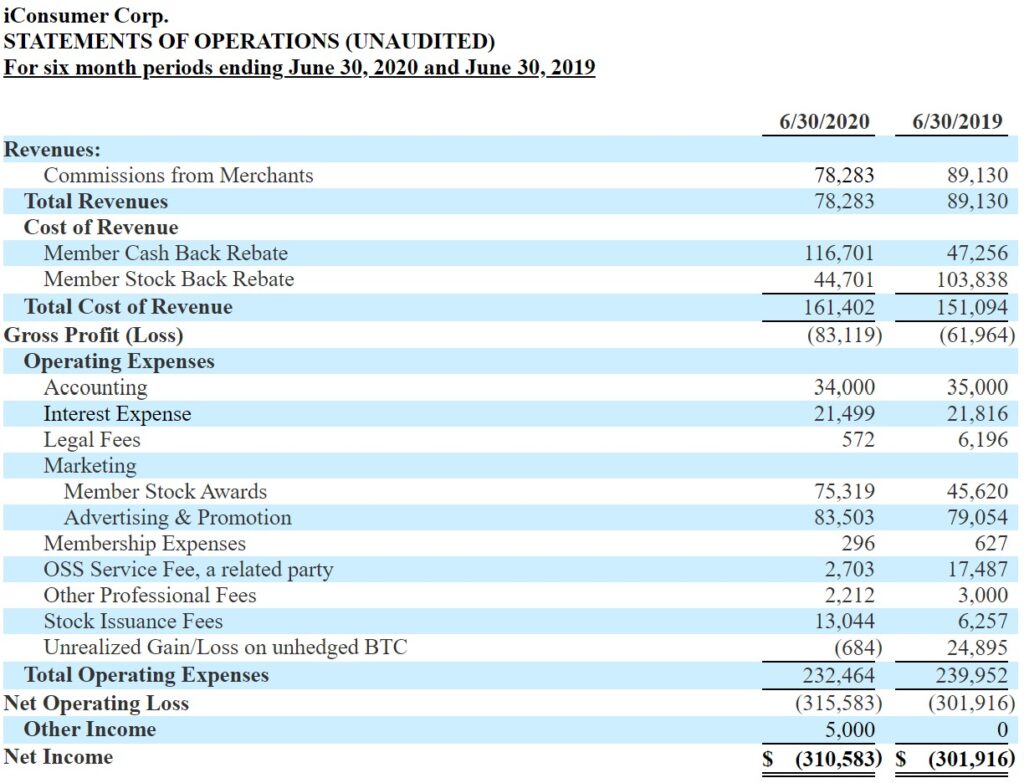

First, we’ll start with the Statement of Operations (you may know of it as a Profit and Loss statement (P&L), or an Income Statement). Just a reminder. When I pull apart the numbers and eliminate the distorting effects of the stock rebate, that’s not official and not SEC sanctioned. I’m providing that for educational purposes. The effect of the stock rebate is real, just not for the discussion of cash.

Revenue / Income

You see that the revenue decreased to $78,283. Because these numbers are for the entire six month period, they hide the month to month variability. The middle of the six months were terrible, the beginning and end not so bad. In March and April and even some of May people were standing in lines trying to buy toilet paper and groceries. Not much else. And while we make a small amount of money from those kinds of purchases if they happen online, it doesn’t fully make up for people not buying a new work outfit at Macy’s or splurging on a trip to Hawaii.

Gross Profit

This is where you begin to see the real challenging effect of the Pandemic Pivot. While on a percentage basis our total numbers don’t look completely awful, the increase in the Cash Back Rebate is awful. It means we have to make up the change elsewhere in the business. You’ll see this better in the statement of cash flows.

Net Loss

We went from a loss of $301,916 to a loss of $310,583, which includes the distorting non-cash effects of the stock. A more useful number right now (since cash is king) is to back out the stock rebates and rewards. For the first six months of 2019 that means we back out $149,458 and for 2020 we back out $120,020 (that’s both the stock back rebates, and any bonuses, like new member bonuses). That’s a net loss of $161,458 for the first six months of 2019 and $190,563 through June 30, 2020.

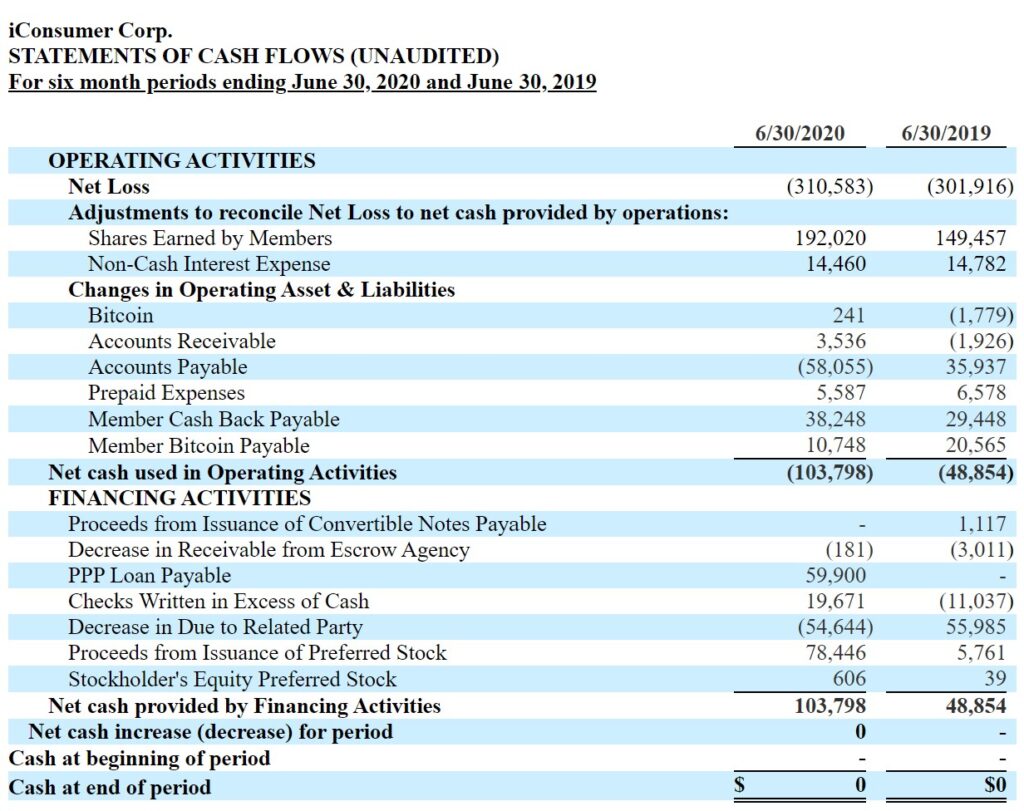

Statement of Cash Flows

This is the key set of official numbers to show how we’re doing. It shows how much cash we used and where that cash came from. Now you can begin to see how the changes we made truly affected us. Note that we used $48,854 in cash more than we generated in the first six months of 2019. And we used $103,798 in cash more than we generated in 2020.

That $103,798 came from two main places. We got an EIDL loan (an SBA (U.S. government) pandemic related loan – it’s mislabeled in the financial statements we submitted as a PPP loan) that’s repayable over 30 years, and we sold $78,446 in stock.

Big Disclaimer

My discussion of these derived numbers does not follow GAAP or SEC rules. They are the numbers I use to understand how we’re doing at the most basic level, and they’re not official accounting numbers. Also, to be very precise, members earn our shares provisionally. That is, we account for them because we assume the member is going to complete the process by, among other things, providing the right ownership information (like social security number), transferring them to the transfer agent, and the purchase isn’t returned. If they don’t complete the paperwork, or fail to remain active, those provisional shares will eventually go away.

Shares that have been issued and transferred are out of our control and can be accessed either through your stock broker or Issuer Direct, our transfer agent.

In other news

Make sure you tell friends. Make sure your Button is working on your PC or Mac. Make sure you have the iConsumer IOS or Android app on your phone. Easy ways to help your company grow and prosper, especially as we head into an uncharted ‘holiday’ shopping season for 2020.