What a month it’s been!

First and foremost, the SEC qualified our offering on June 13, 2018. Which means we’re able to award our stock again. So go shop. I firmly believe that the best way to increase iConsumer’s value is through increasing revenues and profitability.

Next, consider investing in iConsumer. You get the experience of being an investor in an early stage company. Only fat cats got to invest in the early days of Google or Facebook. The 99% can invest in iConsumer before we’re big and famous. We started out selling our stock at $.045/share. Then, we sold at $.09/share. Now, you can buy it from us at $.15/share. The last person to buy our stock on the OTC market paid $.30/share. See what OTCQB: RWRDP is trading at right now.

We’re using your investment in three ways:

- To fund member recruitment. New members are paying for themselves quickly. Which means the more members we can add and the faster we can add them, the better off we are.

- We’re extending the iConsumer platform to get you more cryptocurrencies beyond Bitcoin. Even cooler, we think we can get paid to get you those new tokens for free.

- We’re anxious to get to work creating our own token/coin. We believe that having our own cryptocurrency will be instrumental in helping us grow and become more profitable.

We talk about all of this in our offering circular and Invest Now page.

A look back

With the first trades of our stock in March, 2018, we actually got to the place I was expecting we’d be at much earlier in this journey. I was only off by about two years. I’m rather pleased that much of what I expected to happen, has happened:

- I was expecting that our stock price would be extremely volatile. It has been. It’s been as high as $1.05 per share. As of June 18, 2018 the last trade before yesterday was at $.30 per share.

- I was expecting that we would be very, very thinly traded. That is, there wouldn’t be very many sellers. I was right.

- I was expecting that being a publicly traded startup would make us hard to characterize. Again, I was right.

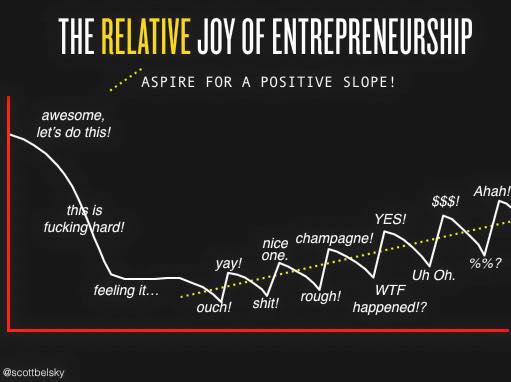

The Roller Coaster

Here’s what I wasn’t expecting (and I have nobody to blame but myself, mostly. I should have asked better questions):

- I wasn’t expecting that it would be this hard for a shareholder to transfer their shares to a brokerage account. I didn’t expect that to cost a lot of money.

- I wasn’t fully expecting that it would be unusually hard to finance this business in the traditional fashion. Because we’re hard to characterize, because we’re already “public”, traditional venture capitalists aren’t interested. Because we’re still a small startup, traditional investment bankers aren’t interested. Which makes small investors, like our members, that much more important to our success.

- Another thing I didn’t expect … that it would take us six months to get our offering qualified by the SEC. Which has meant we need to offer our members the opportunity to reverse every transaction that occurred between February 13, 2018 and May 23, 2018. More about that here. And further, we needed to stop even talking about offering stock until our next offering was qualified. That sucked.

Among the many things that don’t suck are our members and investors. We’ve only just begun to tell folks we’re able to accept investors again, and already some members and prior investors are helping us to meet our goals.

And perhaps best of all, during the period of time when we couldn’t award stock, we had a member say she had stopped buying groceries until she could earn stock again. That’s just so cool. (I do think she meant stuff like cleaning supplies and the like. No members were harmed in the creation of this company.)

P.S. I just published a post on stock price and volatility. If you’re just getting your feet wet in the stock market, it’s a quick read. I talk about why you can expect our stock price to be volatile, and how you don’t have to sell unless you get a price you want to accept.