Leverage iConsumer’s improving results, small float, and thinly-traded stock to position for a serious capital raise.

What we know and believe:

- Our rate of new member acquisition is increasing.

- Our cost of new member acquisition is slowly decreasing. We’re investing about $20-25 to get each of those new members.

- Each of those members is worth about $200 – $400 (based on Honey and Ebates sale prices).

- Small float/thinly traded: there are about 3,500,000 shares held by brokerage firms, of which ~1,250,000 are held by people who won’t or can’t sell.

- At a low stock price, it is economically unattractive for the bulk of iConsumer shareholders to deposit their shares into a brokerage account, keeping the float small.

- About $225,000 buys the entire float (at $.10/share).

- If economics theory hold true, capturing the entire float could raise the price of our stock.

- iConsumer members get excited when our stock price goes up. More members = more shoppers = more iConsumer revenue = more cash in our bank account.

- Increasing revenue and cash increase the likelihood that the stock price goes up.

- More cash gives us greater ability to invest in member recruitment.

- An increasing stock price increases the likelihood that investors will be interested in financing iConsumer’s growth.

The steps:

- Prove that a small amount of activity can move the stock price.

- We asked a small inner circle to make 1,000 share purchases, risking about $100.

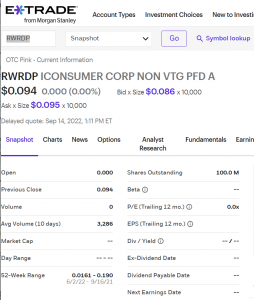

- Three people did this the week of 9/5. One person did this the week of 9/12. The stock price moved UP 17.5%. The bid moved up to $.08, the ask moved up to $.095.

- On 9/15, the bid moved up to $.086. This is an indication that there is rising buying appetite, and that holders of our stock aren’t interested in selling at that price.

- Ask the wider world to get on board. Launch that effort on or about 9/16/22.

- Once the wider world joins in, approach well-heeled investors about leveraging the small float. The pitch: if we get all of you to say “yes”, will you invest X in our traded stock, understanding that it’s a buy and hold?

- Approach institutional level investors.

- Traditional investment banks.

- Crowdfunding platforms.

Important Stuff: Read our offering circular, and our unaudited six month and audited complete year financial statements.