…to consider buying iConsumer stock. The timing seems right. Since it is unfair (and arguably legally wrong) for me to tell them specially, I’m telling all of you at the same time. No favorites here. Not even my youngest brother gets special treatment, and he could use it. (That’s a bit unfair, but he’s a lot younger than I am and I’m duty-bound as the older brother to pick on him at least a little.)

My youngest brother is a major investor in iConsumer, and he uses many of his waking moments (those not devoted to raising 4 kids) to helping iConsumer prosper.

Here’s why I want to suggest this to them (and you)

Good things are happening. Some of them are easy to see publicly (our new member count, for instance).

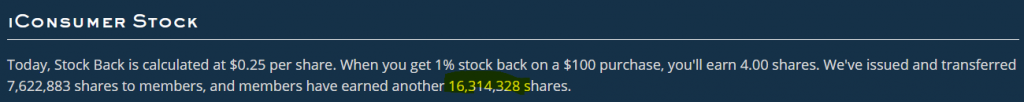

Some will become apparent when we issue our semi-annual financials next month. Some you can interpolate from watching how many shares are being earned.

But other reasons are a little bit more under the covers

For example, our preliminary (and very much subject to change before our financial statements are issued) six month numbers are pleasing to me. Most important, it looks like we about doubled the cash generated from shopping. Cash drives more or less everything. I continued to waive the fees our related company charges iConsumer to provide services so that cash stayed in iConsumer. A very good thing for iConsumer investors. My banker is a bit skeptical.

New member growth continues

That cash we’re beginning to generate helps to pay for the marketing we do to gain new members. We’ve had post pandemic record new member days recently. The new members come from a combo of paid media and member referrals. It’s still early days to predict how much shopping these new members will do, but I’m cautiously optimistic.

New marketing program in test

We’re testing a new paid influencer program, which has the potential to increase the cash we realize from folks’ shopping many fold. We have five influencers on board for a test in September. Interestingly, stores get concerned when you grow too fast. We may have some fun conversations in our future.

Not sticking to our knitting

We’re testing a non-loyalty based revenue stream, with an eye on using that traffic to help build our member base. In the meantime, it generates revenue and cash for us. Classically, we shouldn’t be taking our eyes off the loyalty platform prize, but sometimes being opportunistic can bring significant benefits. I’m hoping that the amount of revenue we’re able to gain from this test and follow-on testing is sufficient to require specific disclosure in our annual financials.

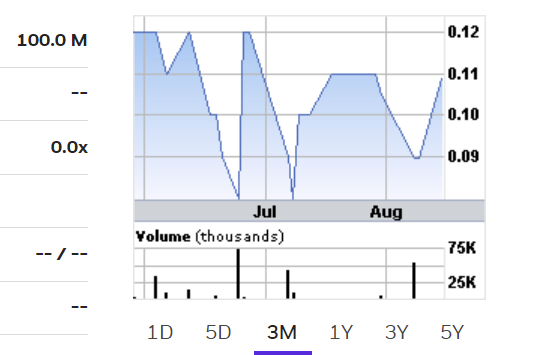

Darn cheap

Lastly, I’m suggesting people consider buying our stock in the stock market because it is so stinkin’ low at the moment. Because the float (the number of shares in the market that can be easily bought or sold via stock brokers and the OTC market) is so small, any buying demand, if the text books are right, should help the price to go up. Zero promises of course.

A stock price that is significantly lower than our offering price is a major reason we have 2X and 3X stock back rebates happening. It helps us adjust for the difference between the market price and the offering price at which we’re required to sell our stock. Those increased rates will go away if and when our stock price goes up. (Hint, hint.)

Another lastly. I’m not suggesting that people consider buying our stock directly from us. It’s so much cheaper in the stock market, plus, (and this is an important data point) I don’t think we’re going to need the cash to help us grow in the near term.

To summarize: Buying stock directly from us at $.25/share currently costs a lot more than buying on the stock market, plus we don’t think we need the cash right now. Buying stock at the current market price of about $.11/share looks cheap to me. Getting stock by shopping — now that’s the cat’s pajamas. You get stock, we get cash, and revenues go up. That’s a formula that may just move our stock price in a positive direction.

And to make my youngest brother happy with a call to action, do remember that we make lots of money when you shop Amazon (go shop), so we benefit hugely, even if you don’t get stock.

Remember, we’re still a startup, so investing in iConsumer has risk.