We’ve published our 2021 year-end financial statements – our SEC mandated 1-K. In the traditional public company world (if we were a “fully-reporting” company), this filing would be called a 10-K. The important difference between the two is the depth that we’re required to go into creating the statements, plus the level of audit required. We’re still held to a “public-company” standard, but if you’re really curious about yet another set of acronyms, Google “PCAOB”. For a company the size of iConsumer, I don’t believe there’s a substantial qualitative difference between the 1-K and the 10-K. There would be definitively a cost difference. Our 1-K cost about $50,000. A 10-K would be about $150,000 – 250,000. We’ll stick with the 1-K as long as we can.

For a pandemic year, not so bad

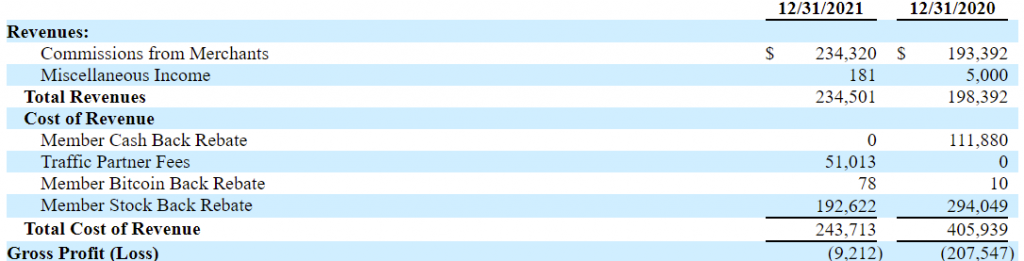

Our top line (revenue) growth felt good and our gross profit growth felt great. It generated some nice cash but it’s a bittersweet story. Much of the growth came from two experimental efforts that ended almost as soon as they started. One of the challenges for 2022 is repeating those successes.

We focus on cash gross profit

Just a reminder, cash gross profit is NOT a real accounting term. In a business that is vitally dependent on the cash it generates for survival and ultimately growth, it’s my shorthand way of getting to the most fundamental measure. The fact that we reward our members with our stock is very, very important (it’s what makes us unique), but it’s not cash, and in fact, can disguise the cash that we generate. At this stage of our growth, it’s still all about the cash.

The cash flow statement gives a great look at how we’re doing, but it’s just a start. By focusing on the cash generated just from “sales” less the cash costs of generating those sales, we can better compare the results of our efforts.

As you can see above, our total revenue (“sales”) for 2021 was $234,501. For the purpose of “cash gross profit”, we’re going to add back the Member Stock Back Rebate ($192,622) – because that’s not cash – to the Cost of Revenue. Giving us a cash gross profit for 2021 of $183,410. And to compare that to 2020, when our comparable cash gross profit was $86,502. Giving us growth of 112% in the cash generated by sales.

That’s good. But it’s not the whole story.

More about the cost of revenue

You’ll note that we have Traffic Partner Fees in our cost of revenue for 2021 when we didn’t in 2020. These resulted from some experiments we ran last year. We used a partner to bring us traffic that was NOT related to earning rebates. Perhaps they would become members, perhaps not. And perhaps they would make a purchase at one of our 2,200 retailers.

A small number of them became members, and a larger number made purchases. That was good. It was a profitable experiment for us. Unfortunately, our partner didn’t make enough money from the experiment to want to continue it.

Amazon and the cost of revenue

Secondly, as we’ve discussed before, the revenue generated by our members shopping at Amazon had no cost of revenue, because we weren’t allowed, nor even given the information that would make it possible, to give rebates.

Even so, we decided that we could convince more members to shop at Amazon. We were quite successful. We were so successful that Amazon took notice of us, and didn’t like it. Amazon decided that, even though we don’t give rebates, they didn’t like our business model. Which meant that they ended their relationship with us. We discuss the impact and size of the Amazon business in our 1-K in more detail. But their leaving us wasn’t good.

Other notable observations

We went through the entire year without really varying from our business model, other than the Amazon and traffic partner experiments highlighted above. The 1-K does a good job of discussing the ins and outs of our business. We actually got a compliment from our attorneys on the Trend section.

The coming year

It feels a bit funny to write about the coming year, given that it’s a third over already. Here are some of the things on my mind that we must address in the balance of the year:

- Inflation

- the war in Ukraine

- continued member growth

- a pandemic that we hope is mostly in our rear view mirror

- replacing and growing beyond Amazon

- stock price

A word on our stock price

Obviously, we don’t control it. Some things would be a lot easier if we did. I believe that an increasing stock price will also increase the interest of people in using and talking about iConsumer.

We’re aware that our offering price (the price we’re required to use when offering our stock as an incentive for rebates, etc.) is currently a bit more than double the current market price. Changing the offering price frequently, or by more than 20% up or down, isn’t feasible.

The way we address that is with the stock back percentage. If the offering price is way out of line (above) the market price, we’ve been changing the stock back percentage so that you get more stock. That drops the effective price of the stock you earn.

If and when (and I certainly hope it’s when) our market price begins to exceed our offering price, we’ll have a different problem to contend with. To keep the math working, we’d reduce the stock back percentage. I look forward to figuring out how to explain that!

Comments welcomed

I’ve tried to keep the post a bit shorter this year, so that our shareholders and others are motivated to ask more questions, and create more interaction. Thanks for reading, and please share a comment.