iConsumer is still very much a startup. While every company worth its salt values its customers and investors, we ESPECIALLY want you to know that we appreciate your support. Being involved in a startup is a special experience, full of interesting (usually interesting = good) twists and turns.

Our Form 1-SA/A recounts our financial journey for the first half of 2019. Reading over last year’s 1-SA, I had highlighted then the fact that we were using Bitcoin. At the end of last year, we returned to cash back instead of Bitcoin.

Keeping the twist and turn theme, after the period these financial statements cover, on August 1 we transitioned completely to stock back based rebates. That makes this year’s 1-SA/A interesting, but probably not indicative of what’s to come.

We discussed the transition to solely stock back here. We’ve discussed some early results of the 100% stock back transition. One of the major reasons for 100% stock back rebates was simplicity of messaging. As we craft our next marketing campaign, it’s already evident that having the singular message of stock back makes drafting that campaign so much easier.

Overview

These statements reflect the fact that during the entire period we were rewarding shoppers with both cash and stock rebates. The target cash back rebate was 80% of our commission revenue. That has competitive advantages (it seems to be the standard percentage used in the cash back industry), but generates very little cash with which to operate. That is, it requires a lot more volume to achieve positive cash flow.

As always, we’ll be discussing our focus on what I call cash gross profit. Fundamentally, how much cash is generated by shoppers. Looking in more detail at how much cash stores pay us and subtract from that the amount of cash back rebates we owe to members. That’s the money we use to pay bills.

The effect of “giving away” our equity

This discussion is mostly a repeat from last year. But it’s still quite important.

You actually earn our equity (we’re not giving it to you – the SEC and our accountants really want us to emphasize that). I agree, it’s important to account for that. But it has no cash effect. That is, you are getting value, but our bank account balance doesn’t go down. Cash is king. Especially for startups.

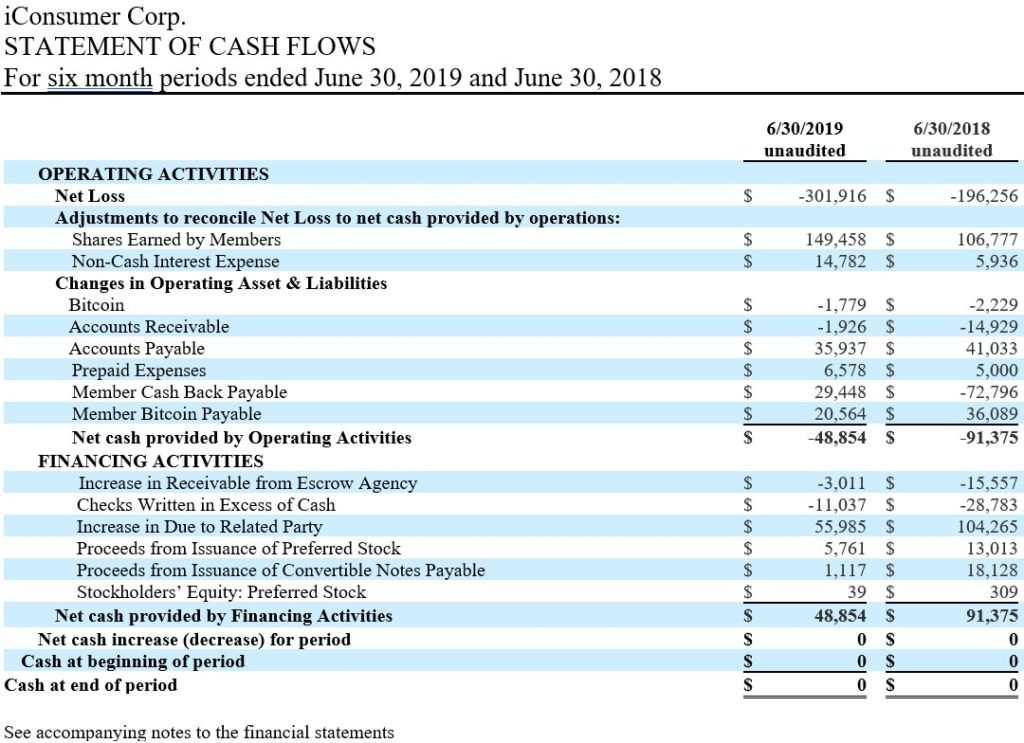

The inclusion of the stock portion of the reward in these statements masks the cash effect, and that’s distracting for cash management purposes. The Statement of Cash Flows goes a long way to present the numbers in a helpful manner. I’m going to go one step further to help you look at what I look at by also unpacking the Gross Profit number in more detail to focus on cash.

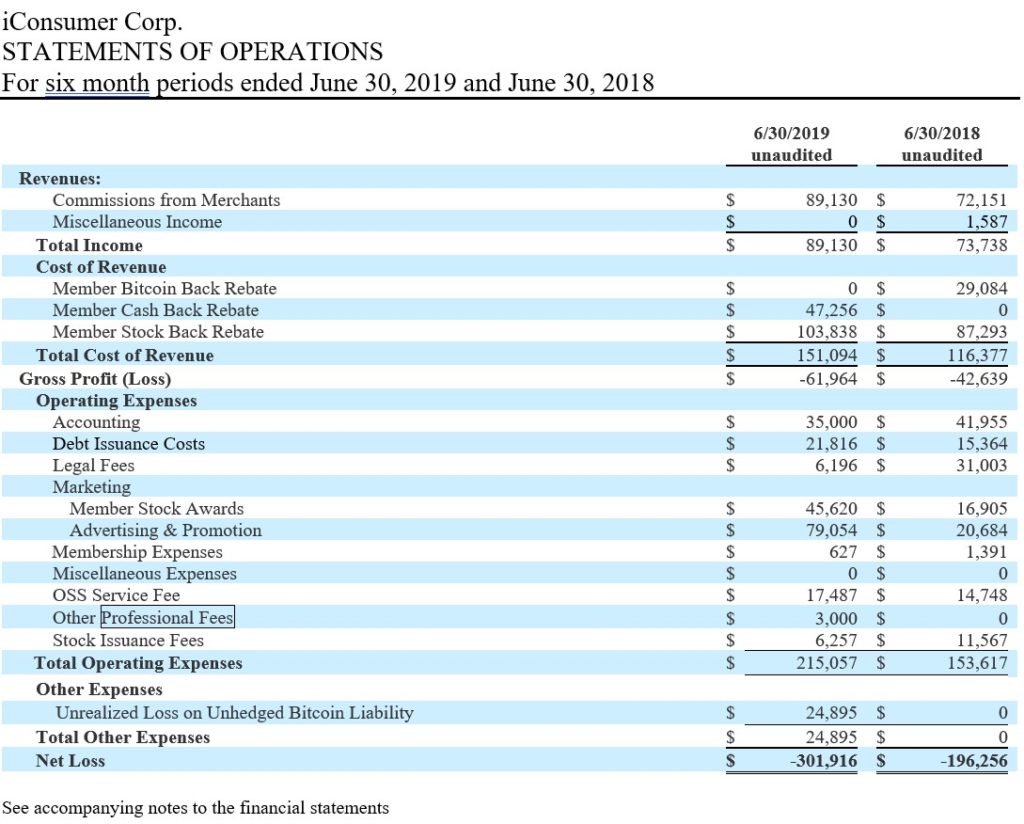

First, we’ll start with the Statement of Operations (you may know of it as a Profit and Loss statement (P&L), or an Income Statement. Just a reminder. When I pull apart the numbers and eliminate the distorting effects of the stock rebate, that’s not official and not SEC sanctioned. I’m providing that to help you learn and understand. The effect of the stock rebate is real, just not for the discussion of cash.

Revenue / Income

We were using Bitcoin as a reward mechanism in 2018, and cash back as the mechanism in 2019. You see that the revenue increased to $89,130, even with the challenges we had faced with using stock as a reward.

For 21 days in late May and early June we weren’t able to offer stock as an incentive mechanism. Just cash back. Which made us no different than any other cash back site. We got ourselves straight with the SEC, and normalcy returned mid June, but we’d hurt ourselves.

This must have affected our revenue, how much, I can’t guess. But it wasn’t good. So I’m glad to see we increased it.

Gross Profit

On the surface, the cost of earning that $89,130 went from $116,377 to $151,094. So our gross profit went from -$42,639 to -$61,694. Not the direction we want to see. However, if you back out the stock back rebate, because that doesn’t have an effect on our bank account (it’s not cash), our cash gross profit went from $44,654 to $41,864. A decrease to be sure, but small. You’ll see this better in the statement of cash flows.

Last year, I said that this was the most important number on our financial statements at this point in our growth. In some ways I’m okay with a small decrease. And in many ways I find it frustrating.

Unrealized Loss on Unhedged Bitcoin Liability

This is new with this financial statement. Fundamentally, we owe more Bitcoin to people for rebates than we own or have hedged. That’s a liability in accounting terms. While the number of Bitcoins we owe continues to go down, the dollar value of that liability goes up and down with the price of Bitcoin. As of June 30, 2019 we owed people X Bitcoin more than we controlled (unhedged). If we had to buy X Bitcoin on that day, it would have cost us $24,895 more than we had already accounted for. But. We didn’t have to buy it (because people hadn’t asked us to transfer it yet). That means it is “unrealized”. Lastly, by doing this we’re “marking to market”, which is the most conservative way of disclosing the value of our assets or liabilities.

This number will change as we transfer Bitcoin to members, and as the price of Bitcoin goes up or down. If the price of Bitcoin goes way down, we might have an Unrealized Gain. Once we no longer either owe people any Bitcoin, or we have bought or hedged exactly the amount of Bitcoin we do owe, this number goes away.

Net Loss

We went from a loss of $196,256 to a loss of $301,916, which includes the distorting non-cash effects of the stock. A more useful number right now (since cash is king) is to back out the stock rebates and rewards. For the first six months of 2018 that means we back out $104,198 and for 2019 $149,458 (that’s both the stock back rebates, and any bonuses, like new member bonuses). That’s a net loss of $92,508 for the first six months of 2018 and $161,458 through June 30, 2019. Not the direction we want to see, but sometimes necessary.

For instance, this came about primarily because we increased our Advertising and Promotion expenses over $58,000 from the year prior. We hope to reap the value of that expenditure later in 2019.

Statement of Cash Flows

This is the key set of official numbers to show how we’re doing. It shows how much cash we used and where that cash came from. Now you can begin to see how the changes we made truly affected us. Note that we used $91,375 in cash more than we generated in the first six months of 2018. And we used $48,854 in cash more than we generated in 2019. Which meant that we had to finance $42,521 less in 2019.

That’s an important improvement, and that makes me very happy, because the increase of $55,985 in Due to Related Party is the money I lent iConsumer this year. Down from the $104,985 I lent it in the first six months of 2018.

Big Disclaimer

My discussion of these derived numbers does not follow GAAP or SEC rules. They are the numbers I use to understand how we’re doing at the most basic level, and they’re not official accounting numbers. Also, to be very precise, members earn our shares provisionally. That is, we account for them because we assume the member is going to complete the process by, among other things, providing the right ownership information (like social security number), transferring them to the transfer agent, and the purchase isn’t returned. If they don’t complete the paperwork, or fail to remain active, those provisional shares will eventually go away.

Shares that have been issued and transferred are out of our control and can be accessed either through your stock broker or Issuer Direct, our transfer agent.

In other news

Make sure you tell friends. Make sure your Button is working on your PC or Mac. Make sure you have the iConsumer IOS or Android app on your phone. Easy ways to help your company grow and prosper.