One update to cover them all.

Bitcoin Exposure

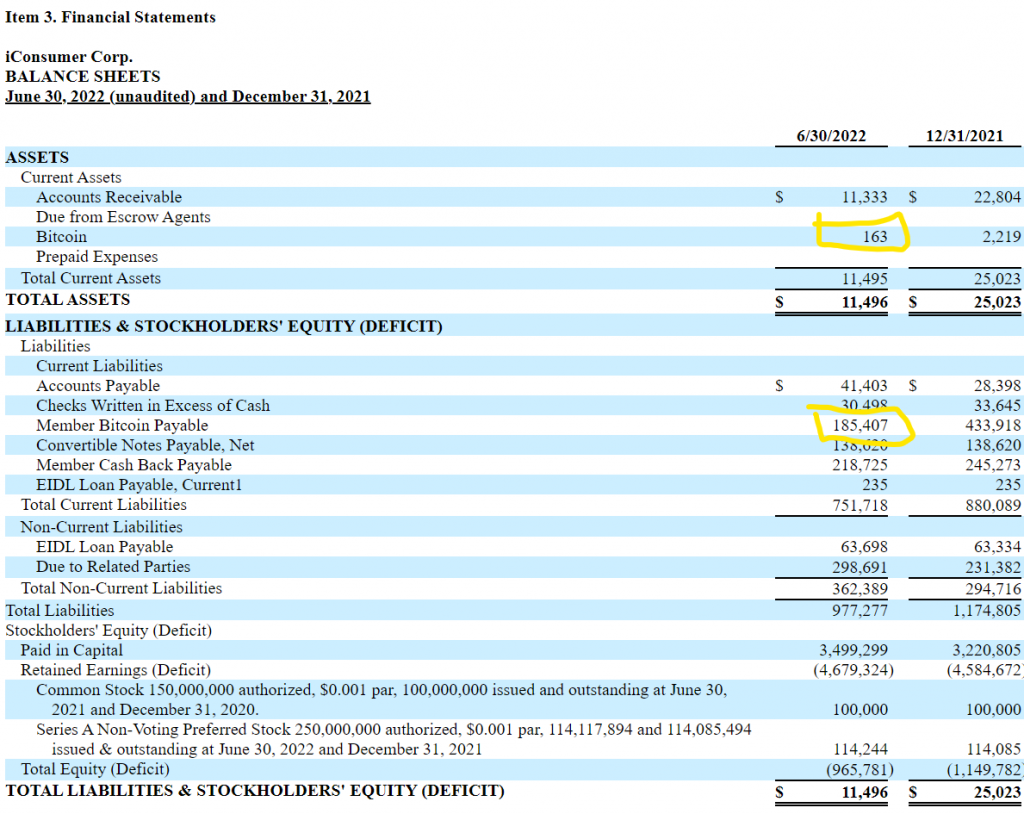

In the past, iConsumer has offered Bitcoin as a reward. We stopped that practice several years ago, but we still have assets and liabilities linked to that effort. Also, we allow you to redeem cash back balances via Bitcoin. The current activity in the Bitcoin world (FTX going bankrupt and the related meltdowns) aren’t affecting us to any great extent. As outlined in our financial statements, we only hold sufficient Bitcoin in our own wallet to satisfy a month’s worth of expected redemptions. We don’t currently hold Bitcoin in any other wallets or on any exchanges. As of June 30, 2022 the total value of the Bitcoin we hold was $163, and that was at the price on June 30, 2022 ($18,734).

We owe people Bitcoin. As of June 30, 2022 that amount was $185,407. Again, calculated at $18,734. Since Bitcoin is valued (right now) at about$16,500 our Bitcoin denominated liability has been reduced by about 14%, assuming we still owe the same amount of Bitcoin as we did on June 30, 2022. Looked at another way, we’ve “shorted” Bitcoin. If the price doesn’t go up by year end, we will show a gain on our financial statements.

The biggest risk to us with this position is if Bitcoin goes up in value AND if members seek to redeem the Bitcoin we owe them.

3X Cash Back Rewards

As expected, introducing Cash Back Rewards has positively affected our revenue, our cash flow, and negatively impacted our margins (how much we get to keep from each dollar of revenue we earn). We will begin to adjust stock back percentages towards the end of the holiday shopping season.

New Member Acquisition

Perhaps the most gratifying change resulting from our adopting an aggressive cash back stance is the increase in the rate of new members joining, plus the significant reduction in the cash cost of attracting those new members. Our average cash investment per new shopper is now less than $10.

One of the critical metrics we’ll be watching is the amount of time it takes for a new shopper to pay for themselves. That is, how many days does it take after we pay out that $10 acquisition cost for a shopper to generate $10 in gross margin (commission less cash back). Fewer is better.

We don’t have a handle on that yet. It’s been too short a period of time since we introduced cash back, plus holiday shopping will distort that calculation.

As an interesting side note, while the speed of pay back is important, the absolute amount of shopping per person is perhaps even more important. Based on the amount of money eBates and Honey got when they sold, we estimate each new member is worth somewhere between $200 – 400. If our new shoppers are all big spenders, perhaps they’re worth more. Or, conversely, if they just dabble, they’ll be worth less.

Lastly, I think that more is better when it comes to shoppers. There are lots of things that make sense for us to do to earn money once we’re big enough that we don’t do now.

Housekeeping – Updated Terms of Service

Our terms of service needed to be updated to reflect cash back rewards, plus we wanted to tighten up our exposure to the troubles affecting the Bitcoin world. You can see the old terms of service here, and the updated terms of service here.