I’m writing this post as our stock price continues to bounce up and down (mostly up), closing today at $.18/share. That upward movement is our community laying the groundwork for us to raise significant capital in 2023. I’m talking to investment banker types, crowdfunding platform types, and lawyers about the how and why of that potential raise. Having a rising stock price makes those conversations much easier to come by.

In those conversations, I find myself relating the circumstances that led to The Plan. Part of the promise of iConsumer was that I would share our journey in educationally focused posts. In that spirit, here are some of the weird aftereffects of being pioneers in the Reg. A+ equity crowdfunding world and our leveraging them to make lemonade.

The Background

We were perhaps the third company to file a Reg. A+ Tier 2 offering. Everybody was a pioneer. In no particular order, here are some of the arrows we found in our back.

- We were listed on the OTC too early. We weren’t ready.

- We over-estimated the amount of money we should raise.

- Nobody knew about equity crowdfunding yet. We knew that going in, but weren’t able to overcome it.

- Transferring stock into a transfer agent, and then into a stock brokerage was hard. It got way harder, much more expensive, and nearly impossible, as stock brokers weren’t interested in accepting deposits of our stock.

The Lemons

Because of all of the above, plus Covid, plus our trying out Bitcoin rebates and cash back rebates (self-inflicted challenges) when we launched The Plan, these were the challenges we faced:

- Hardly any float: about 3% of our 114,000,000 issued shares are available to trade (stock held in stock brokerage accounts, not held at the transfer agent).

- Of that, about 2,500,000 shares are held by people who can’t (or won’t) trade them, reducing the float even further.

- Near impossible for shareholders to increase the float by transferring shares into a brokerage account.

- A rising stock price seems to excite members to join and shop. Our stock price lived in the basement and wasn’t moving.

- No stock market activity (no buying and selling).

- No institutional backing.

- A stock market price that was below our offering price. (It is basically impossible for us to change our offering price more than 20% up or down and stay in business.)

- Nobody in their right mind would invest directly in iConsumer (buy stock from us) when they can buy stock in the stock market – stock that has already gone through the pain of being deposited into a brokerage account – at a much lower price.

The Lemonade

It’s really the first four bullet points above. No float and no real possibility of increasing the float means that any buying activity stands an outsized chance of increasing the stock market price. Even at $.25/share, you could buy a lot of stock for the price of a nice dinner (more volume is helpful). Getting the stock price up could result in more revenue – a fundamental change in iConsumer’s fortunes that might also help the stock price go up. I set out to encourage people to buy (with their eyes wide open as this is quite risky) because I think there is an outsized opportunity here. They understand that the way The Plan will work is if they’re willing to buy and hold (no quick exits).

Success breeds success. Elsewhere I’ve called it a self-fulfilling prophecy. If you like what’s going on, you might tell your friends, and they might tell their friends, etc. etc.

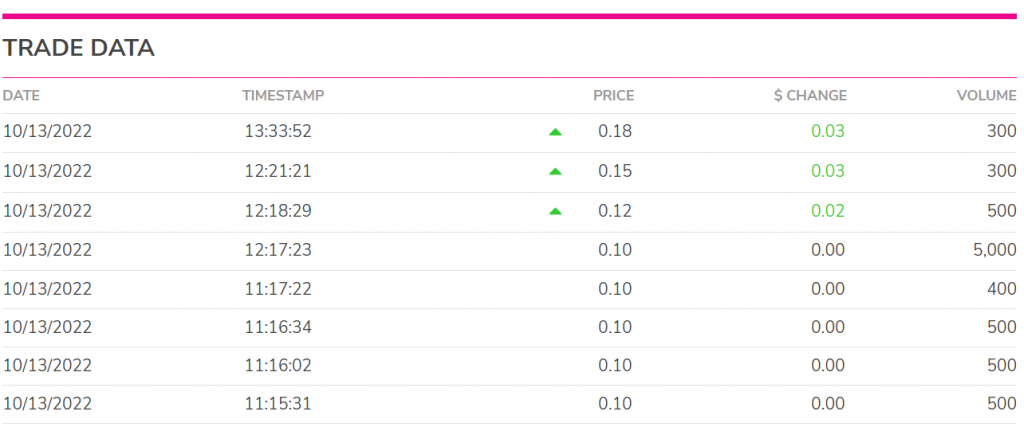

And somebody (actually I know it’s a bunch of somebodies) have responded. Today’s close at $.18 is more proof of that. It demonstrates how easily the stock price can go up. 500 shares got the price up to $.12/share. Another 300 shares got it up to $.15, and finally, somebody invested $54, bought 300 shares, and the price closed at $.18/share. Had I chosen another day as an example, it could also show how easily the stock price can go down (but almost always it goes right back up as somebody steps up to keep the stock price moving). Over time, as more people buy with the expectation of holding, the number of sellers should go down, the available float held by people who can or would sell goes down, and the upward pressure on price can win.

Stay Tuned

In one of my next posts, I’m going to talk about what I’m learning about the current state of the equity crowdfunding world, how it is significantly different and better from the pioneering days, and why I think it may have an important role to play in our next raise.

Reg. FD Info – SEC Regulation Full Disclosure

I need to be able to share info that might normally be kept under the covers (confidential) with these prospective investors and crowdfunding platforms. In other words, by sharing these educational posts with you, I’m also covering the obligation to keep everybody on a level playing field. No insider information here. It’s a bit like playing poker with a hand of cards everybody can see.

Indeed, I’m hoping that some of the folks I talk with like what they see so much that they go dabble in our stock, before any big commitments. As always, please read our offering circular and financial statements.